what to look for before investing in a company

Tabular array of Contents

- one 5 Things to Look for in a Company Before Investing

- 1.1 1. Information on its Industry (Take a Deep Dive)

- 1.two two. One, Three, and 5 Year Functioning

- i.3 3. Stiff Leadership

- i.four 4. Contempo News

- i.v five. Annual and Quarterly Reports

- 1.6 Decision

- ane.7 One Platform. I System. Every Tool

5 Things to Look for in a Company Before Investing

Do you take big plans to invest money in a particular company? Are you wondering if you should movement forward immediately, or take a pace back to learn more? Exercise you know what to look for before investing?

It's easy to find yourself pulled in different directions.

On the plus side, you lot know there's potential to generate a positive return in the stock market. You're familiar with the statistics, such as this one (courtesy of CreditDonkey):

"The average stock marketplace return is around 7%. This takes into business relationship the periods of highs, such equally the 1950s, when returns were every bit much every bit xvi%. Information technology also takes into account the negative 3% returns in the 2000s."

On the downside, at that place's no guaranteed render in the wonderful world of stock marketplace investing. Fifty-fifty when things are going well, there'south ever the possibility of losing coin.

Download a PDF version of this postal service every bit PDF.

Fortunately (or unfortunately), when it comes to the stock market, things don't stay the aforementioned forever. Here'south a quote from investment keen Lou Simpson that speaks to this:

"In many ways, the stock market is like the weather in that if you don't similar the current weather all you have to do is wait a while. "

While fearfulness and dubiousness are sure to pitter-patter into your mind, don't let this stop y'all dead in your tracks.

Instead, take the fourth dimension to grow your knowledge base, answer primal questions, and settle on a strategy for chasing your brusque- and long-term goals.

This brings us back to the get-go paragraph: You must know what to look for in a company before investing.

If you're ready to start the inquiry procedure, here are v things to look for earlier investing:

1. Information on its Industry (Take a Deep Dive)

This should go without saying, but information technology's a fault that many new (and experienced) investors make.

At the 1999 Berkshire Hathaway Almanac Meeting, Warren Buffett gave some of the best communication you lot'll ever hear:

"Different people understand different businesses. And the important thing is to know which ones you do empathise and when you're operating within what I call your circle of competence."

In other words, you demand to invest in what y'all empathize and ignore everything else (until you abound your noesis base, of form).

For example, if you're deeply involved in social media — maybe because this is the industry in which you lot piece of work — investing in Facebook, Twitter, and LinkedIn may brand skilful sense.

Conversely, if you don't know anything about the internet or engineering science, it doesn't brand sense to throw your coin at companies in this space.

Check out the v-year Facebook chart beneath.

Photo: StocksToTrade.com

Every bit y'all can see, it was trading around $24 in June 2013. Fast forward to today, and it's now trading at roughly $200.

If you understand the social media industry and are familiar with Facebook's history and future plans, yous're in a position to invest with confidence.

But if yous're only chasing the bright lights, assuming the stock price will grow 8x again over the side by side five years, you could be disappointed.

Before investing, exercise any it takes to conspicuously understand a company'south manufacture and where it fits in.

ii. One, Three, and Five Year Operation

To empathize if a stock is a good investment, y'all must first dive into what's happened in the past (so you can projection your thoughts on the future).

With the assist of StocksToTrade, for instance, you tin chop-chop read old news stories and review past filings, events, and other key data earlier investing. This alone will requite you a articulate thought of what'due south happened to the company as a whole, besides as its earnings history and outlook.

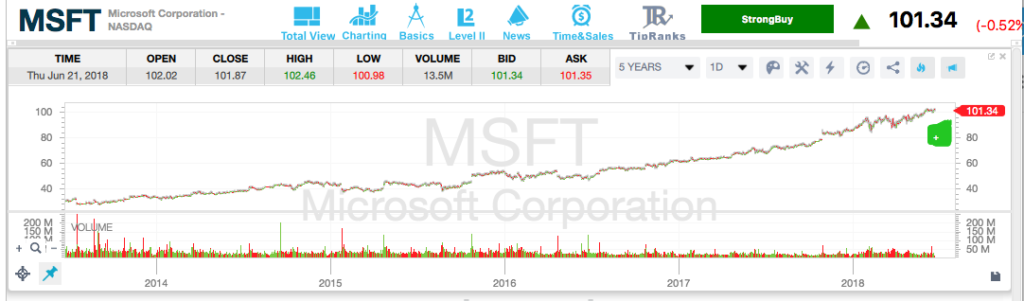

Does the company have a strong history of growth? A company similar Microsoft is a great case.

Photograph: StocksToTrade.com

Or are earnings volatile, thus resulting in a more risky investment?

Just the same as annihilation else, the past doesn't always dictate the future in the stock market. Even when everything is going well and you're making money, something can go wrong that leads to the stock tanking.

It only takes a few minutes to review a visitor'southward one-, three-, and five-year performance. When you combine this data with contempo news, earnings history, and forecast data, you'll feel better about what'due south to come.

3. Strong Leadership

There'due south no other manner of putting it: Y'all desire to invest in companies with stiff leadership, from the height downward.

While it'due south ideal to find companies with stability at the top, this is easier said than washed. Not only that, simply things can and will change as the years go past.

Imagine this: You're interested in investing in a particular company, simply a new CEO has but taken over. Practice you ignore this and dive right in? Do you sit back to see how things shake out earlier making your movement?

A change in stock price after a change in leadership isn't guaranteed, but it's something to watch for.

For case, if the new CEO doesn't accept much feel in the industry, investors may have concerns most a shift in strategy and the overall direction of the company.

On the aforementioned token, if a well-established professional within the industry is moved into the role, the change could be proficient for the company, thus boosting the price per share.

We know that CEOs are paid a lot of money, simply that shouldn't mean much to you every bit an investor. What you really want to know is whether the person is a strong performer who is capable of growing the company and helping you make money.

If you don't know where to start, check out this list from Glassdoor that outlines the top CEOs of 2018 (as voted on by employees).

While these CEOs are popular amid their workforce, it doesn't necessarily mean they're strong leaders. However, information technology's a skillful place to beginning if you're seeking more information on a visitor in which yous're interested in investing.

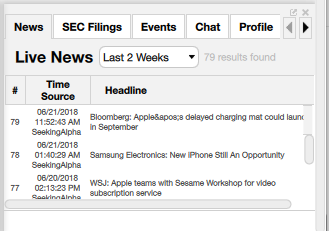

4. Recent News

Good news about a company can become a long mode in taking its toll per share to new heights.

Merely the same, bad news can quickly trounce a company and have investors wondering what went incorrect.

Before investing in any company— even one that has a strong reputation for long-term success — you need to read as many news manufactures equally possible (ideally, dating dorsum a few months).

With StocksToTrade, you have access to breaking news along with stories dating back several weeks.

Photo: StocksToTrade.com

Here's an interesting excerpt from a CNBC story from September 2017, detailing the impact of the delayed iPhone X release date on Apple tree shares:

"While the iPhone viii and iPhone 8 Plus will be out in September, when Apple typically launches its new iPhones, the iPhone X will launch later. Customers will exist able to pre-order the iPhone 10 beginning in Oct before it launches in Nov. This is unprecedented for Apple, which hasn't ever launched an iPhone so late in the year, so close to the important holiday shopping flavour. Past the time the effect was over, Apple shares had slid to $160.twenty and were in the red slightly for the 24-hour interval."

Some companies, such as Apple and other big proper name brands, always seem to be at the eye of their respective industries.

Others, however, wing under the radar in regards to the number of news stories published about them. This doesn't mean you should overlook these companies or assume that zippo is happening — you just need to dig deeper.

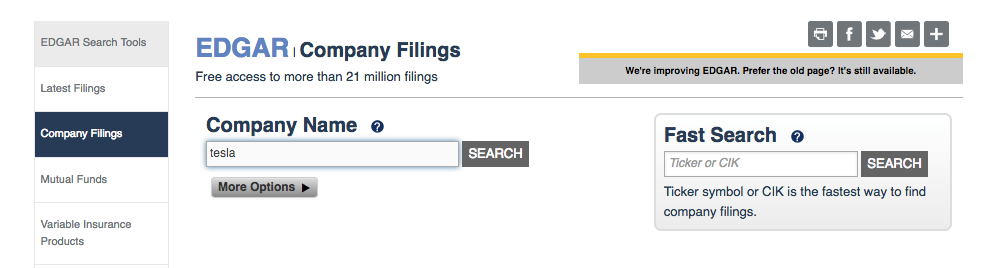

v. Annual and Quarterly Reports

If you're a serious investor who wants to make informed trades, yous need to get into the habit of reading and comparison almanac and quarterly reports.

For example, the 10-K report is an annual report that every publicly traded company is required to submit to the Security and Exchange Committee (SEC).

Along the same lines, the 10-Q is required to be filed on a quarterly basis.

The SEC provides access to more than 21 meg filings, all of which are full of useful information.

Photo: EDGAR

It goes without saying that you don't accept enough fourth dimension to read through all of these, but if you're interested in investing in a specific company, then you should take a deep dive.

As you comb through 10-K and x-Q filings, pay shut attention to the risk factors listed. This will give you lot a better thought of cerise flags that could result in hereafter trouble.

Here's a nifty resource from the SEC if you're interested in learning how to read a 10-K. It outlines a clarification of each section, as well as the best practices for using the information.

If you come across something yous don't like, it doesn't necessarily mean you should cross the stock off your listing. It merely means you should dig deeper to get a amend experience for the potential bear on on the company as a whole and its time to come stock price.

Conclusion

Every bit you tin come across, it'southward non difficult to larn more about a public visitor. All it takes is time, dedication, and knowledge of what is — and isn't — of import.

At present that you lot know what to look for earlier investing, you're set up. So, cull a stock that makes sense for you, keep close tabs on its operation, and never finish learning.

With the aid of STT Pro, you can larn to make investment decisions that increase your chances of success.

Source: https://stockstotrade.com/5-things-to-look-for-before-investing/

0 Response to "what to look for before investing in a company"

Post a Comment